The Search for Answers: Why Financial Services Can’t Afford Misinformation

In times of crisis, people naturally go searching for answers – it’s human nature.

And while the internet has made this search easier, the prevalence of misinformation online has made getting the right answer a lot less straightforward.

This pandemic has brought about a lot of questions, many of which aren’t health related. Because with the economy facing so much uncertainty, people are growing increasingly worried about their financial health.

In our latest research, we wanted to understand how this crisis had affected the public’s attitude towards financial services, and what financial brands can do to ensure they deliver excellent customer experiences.

Some key highlights from the research include:

- 93% of UK consumers think financial services could be improved with either a live chat or better way to get answers to their questions

- Only 63% are satisfied with the up-to-date information from their insurance company or bank

- We’re searching online for banking information eight times a month on average

- 53% are more likely to either buy insurance online or bank online after the pandemic than before it

Yext helps organisations deliver the right answers everywhere your customers search. Learn more below.

The cost of inaccuracy

We found that online searches for financial services information has indeed grown throughout lockdown. The average customer now searches online for banking information eight times a month.

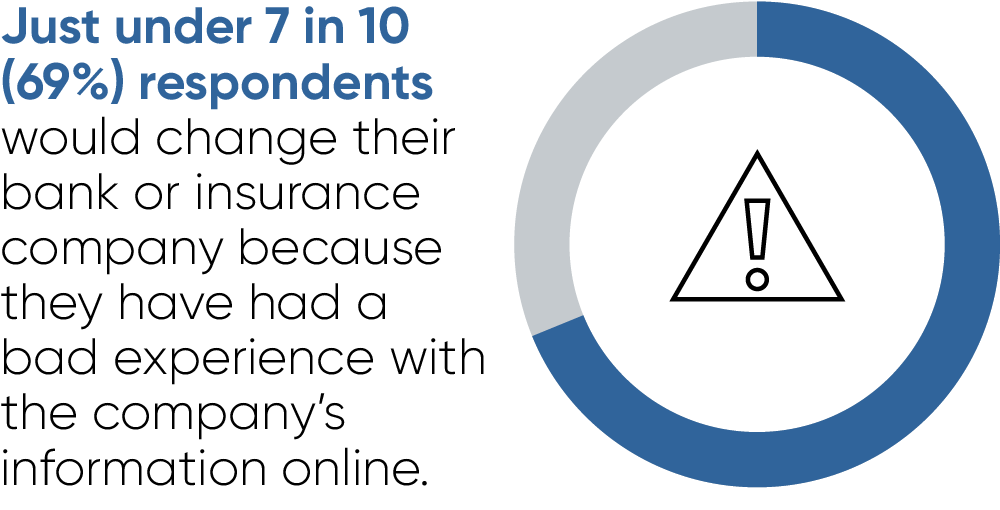

However, what’s more noteworthy is the level of hostility customers have towards financial brands that spread inaccurate information. Close to 7 in 10 (69%) people we spoke to said they were willing to change their bank or insurance company over incorrect information online.

The pandemic has brought the fear of bad information to the fore of many customers’ minds, with three in five (63%) of consumers concerned about misinformation online.

And it’s not unfounded - 42% of workers have received suspicious emails since they started working from home. Cyber-attackers are trying to take advantage of the present situation, so customers know they need to be cautious.

But it isn’t all doom and gloom. The present uncertainty also has people re-considering a lot of their financial choices. And financial firms that understand what’s motivating customers right now will be better able to cater to them.

Mastering search in a post-Covid world

What financial institutions need to work on during this period is the relevance and scope of the information they provide, to counter the negative reaction to misinformation customers have had over lockdown.

Only 63% of customers are satisfied with how up-to-date the information they’ve received from their insurance company or bank has been.

And a whopping 93% of them think services could be improved with either live chat or an alternative way to get answers to their questions. By improving the relevance of the answers delivered through an intelligent live chat, consumers will feel more connected to their provider, and receive timely, useful information when they need it.

That said, this period has had a significantly positive impact on attitudes towards online financial services.

Without the ability to go into branches, a lot more people have had to engage with their banks online. As such, more than half (53%) of those surveyed agree that they’re more likely to either buy insurance online or bank online after the pandemic than before it.

And these institutions are still fundamentally viewed as trustworthy - two thirds (67%) of customers trust the information given to them online by financial service brands.

So, while there’s still a lot of work to be done to improve the relevancy of the information consumers receive, there is a significant opportunity for those getting it right.

Understanding customers in lockdown

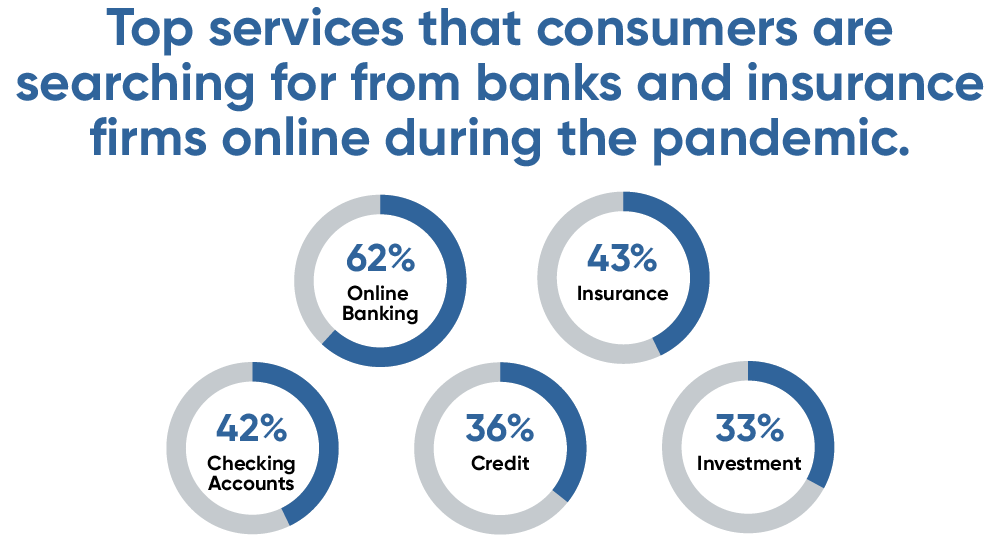

When it comes down to it, people mainly just want to know their money is safe and being managed well right now. So, it’s no surprise that online banking was the top service customers were searching for (62%).

People are also approaching their search with very specific questions and are seeking equally detailed answers.

We found that more than a quarter (27%) of people were looking for specific services such as credit, investment and accident insurance. A similar proportion have been searching for opening hours (24%) and the specific names of banks or insurance companies (24%) more often.

This has raised the bar for the quality of information financial service brands release. Providing wrong, outdated or unclear information can be devastating to the reputation of a business - and these days, reputation is everything!

For example, nearly four in five (77%) of consumers said reviews are important to them if they’re choosing a bank or insurance company. And outside of reviews, the recommendations customers gravitate to the most are:

- Results of rating and comparison portals such as Money Supermarket (39%)

- Family members (31%)

- Friends and acquaintances (25%)

- Consumer advice from organisations like the Citizens Advice Bureau (22%)

- Search engine results (Google, Yahoo, Bing, etc.) (21%)

To rank highly in any of the above requires a good online reputation. And more than ever, that reputation is tied to the quality of information brands put out into the world.

Financial services are built on trust. If businesses don’t provide satisfactory answers to customers’ questions, they’re eroding the foundation of their enterprise.

Information is a key asset when it comes to maintaining and strengthening consumer confidence - so it needs to be relevant, timely and, more than anything else, accurate.

Get in touch with Yext to learn more about how you can give your customers the answers they’re looking for, and use search to drive traffic to your site to make the most of the growing online opportunities across the UK.

Want more like this?

Want more like this?

Insight delivered to your inbox

Keep up to date with our free email. Hand picked whitepapers and posts from our blog, as well as exclusive videos and webinar invitations keep our Users one step ahead.

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy

Other content you may be interested in

Categories

Categories

Categories

Want more like this?

Want more like this?

Insight delivered to your inbox

Keep up to date with our free email. Hand picked whitepapers and posts from our blog, as well as exclusive videos and webinar invitations keep our Users one step ahead.

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy